Retirement loans, especially car title loans, offer seniors flexible emergency fund alternatives by leveraging vehicle equity for quick funding. While traditional savings accounts are preferred for immediate crises, retirement loans provide fast cash through options like semi truck loans with more flexible eligibility. However, these short-term solutions carry high-interest rates and strict repayments, requiring careful assessment of financial health and repayment ability to avoid debt spirals and long-term risks.

In today’s unpredictable financial landscape, exploring creative solutions for emergency funding is essential. Considering retirement loans as alternatives to traditional emergency funds can offer a unique safety net. This article guides you through unlocking access to your hard-earned savings with retirement loans, comparing them to conventional options like car title loans. We’ll navigate the risks and benefits, empowering you to make informed decisions for enhanced financial security.

- Understanding Retirement Loans: Unlocking Access to Funds

- Comparing Retirement Loans vs. Traditional Emergency Funds

- Navigating Risks and Benefits for Financial Security

Understanding Retirement Loans: Unlocking Access to Funds

Retirement loans are emerging as a flexible solution for individuals seeking emergency funding alternatives beyond traditional methods. These specialized financial instruments allow seniors to access their hard-earned savings, offering a unique opportunity to bridge financial gaps during unforeseen circumstances. By tapping into retirement funds, whether through reverse mortgages or other innovative products, individuals can maintain financial stability without depleting their long-term savings or relying solely on external borrowing.

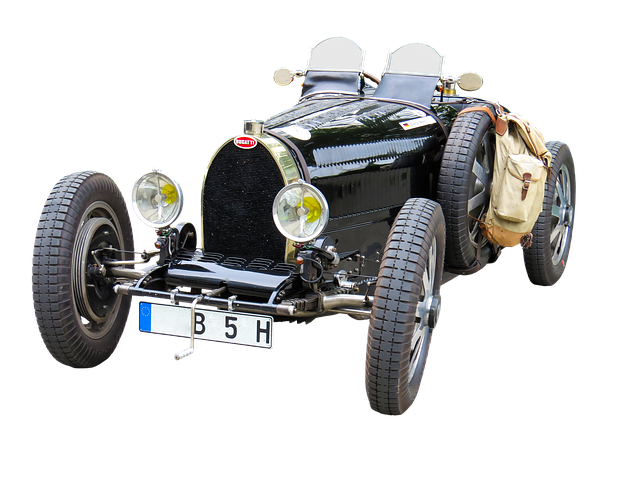

One popular option gaining traction is the car title loan, which serves as an accessible emergency fund alternative. This type of loan leverages the equity in one’s vehicle, providing a quick and straightforward way to secure funds. With an online application process, individuals can easily explore their borrowing options, ensuring a smooth and efficient loan approval journey. This approach not only offers immediate relief but also preserves the integrity of one’s retirement savings, making it a strategic choice for those looking to maintain financial control during challenging times.

Comparing Retirement Loans vs. Traditional Emergency Funds

When considering options for funding unexpected expenses, many individuals overlook retirement loans as viable car title loan emergency fund alternatives. Traditional emergency funds, typically stored in savings accounts or money market funds, offer a safe haven for readily accessible cash during financial emergencies. However, retirement loans provide an intriguing proposition, especially for those who possess assets like real estate or vehicles, offering a chance to tap into their wealth without liquidating it.

Compared to setting aside funds for an emergency, retirement loans have their own set of advantages. For instance, these loans can offer faster access to fast cash, particularly with options like semi truck loans catering to specific asset types. Additionally, loan eligibility criteria may be more flexible, allowing borrowers to secure funding based on collateral value rather than strict credit score requirements. This alternative could prove beneficial for those who prefer not to deplete their emergency funds or don’t have the luxury of time when facing financial emergencies.

Navigating Risks and Benefits for Financial Security

Navigating the world of retirement loans as emergency fund alternatives requires a thoughtful balance between risks and benefits. While options like car title loan emergency funds can provide quick access to cash during unforeseen circumstances, they come with significant risks. These short-term solutions often carry high-interest rates and strict repayment terms, which can create a cycle of debt if not managed carefully.

Considering San Antonio Loans or Houston Title Loans, for instance, individuals must weigh the urgency of their financial need against the potential long-term implications. A title transfer, as an alternative to traditional emergency funds, can offer liquidity but may also put assets at risk. It’s crucial to evaluate one’s financial health, retirement savings, and ability to repay such loans before exploring these alternatives, ensuring a strategy that promotes both immediate relief and lasting financial security.

When considering your financial options, retirement loans can serve as viable alternatives to traditional emergency funds, especially for those facing cash flow challenges. By tapping into these specialized loans, individuals can access immediate liquidity without compromising their future savings. However, it’s crucial to weigh the risks and benefits carefully, ensuring that a retirement loan aligns with your long-term financial goals and provides a safer haven during emergencies, potentially offering a more flexible solution than a car title loan emergency fund alternative.